Utilizing Real-Time Data to Increase Mining Yields and Stay Ahead in Crypto Mining

In the world of cryptocurrency, where fortunes are made and lost in the blink of an eye, the landscape of mining has evolved dramatically. As crypto enthusiasts diversify their portfolios, the focus has shifted to maximizing mining yields. Utilizing real-time data emerges as a powerful strategy to navigate this volatile terrain effectively. With machines producing countless hashes every second, understanding how to leverage data can set a miner apart from the rest.

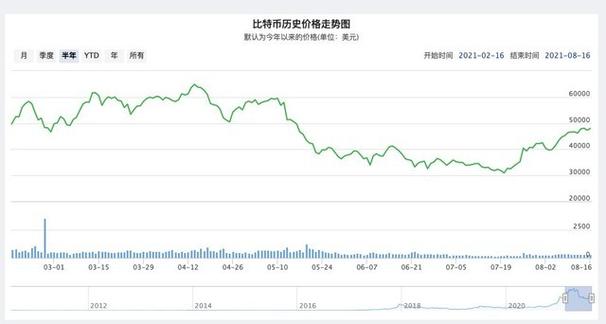

Firstly, let’s delve into what real-time data actually means in the context of mining cryptocurrencies like Bitcoin and Ethereum. Real-time data involves immediate and updated information about network conditions, mining difficulty, hash rates, and market prices. Miners can gather crucial insights that inform their operational strategies. For instance, if the Bitcoin network experiences a surge in mining difficulty, miners can immediately reassess their operations to ensure continued profitability. They may decide to switch to more profitable coins or decide if hosting their mining rigs on a cloud service is more advantageous.

Moreover, the significance of real-time tracking cannot be overstated. Speedy decisions can lead to optimized performance and reduced operational costs. Imagine a miner equipped with analytics tools that visualize hash rate fluctuations against cryptocurrency market trends. This miner would see when it is better to mine Bitcoin and when to switch to Ethereum or even Dogecoin. Routine data analysis aids in forecasting potentially lucrative periods—essentially laying the groundwork for strategic pivots in mining focus.

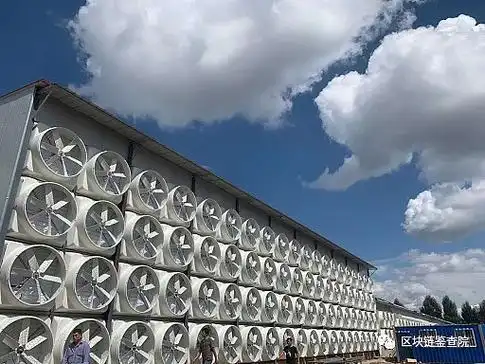

Adding depth to the discussion about mining, let’s consider the hosting of mining machinery. As many miners opt for off-site hosting solutions due to the high costs and maintenance burdens of running mining rigs at home, the incorporation of real-time analytics in hosting becomes imperative. Hosting facilities often provide miners with robust data analytics platforms that not only monitor efficiency but also ensure adherence to best practices in cooling and electrical consumption. Understanding these parameters helps miners maximize their yield while minimizing excessive energy costs, which are a significant drain on profits.

Additionally, the choice of mining rig directly impacts potential profits. The dynamic nature of cryptocurrency prices poses a challenge, particularly when it comes to selecting the right hardware. Over time, certain models of ASIC miners have proven to outperform others based on the specific currency being mined. Therefore, real-time data plays a pivotal role in guiding purchasing decisions for new rigs or optimizing the performance of existing machines. Keeping abreast of technological advancements while tracking real-time metrics ensures that miners are always one step ahead.

It’s crucial to highlight the benefits of integration in real-time data tracking with exchange platforms. Cryptocurrency markets exhibit extreme volatility, and prices change frequently—more so than in traditional markets. Miners who monitor exchange rates can make informed decisions about when to sell their mined coins. The faster they react, the better their potential profits are preserved. High-frequency trading in tandem with real-time data can create significant arbitrage opportunities, emphasizing why miners should be plugged into comprehensive analytical tools.

The essence of effectively utilizing real-time data extends beyond mere calculation—it’s about understanding trends and making educated decisions that align with a miner’s specific goals and risk tolerance. Each cryptocurrency presents unique challenges and opportunities; hence, mining strategies must be uniquely tailored. Miners must harness the power of this data not only to adjust their methodologies but also to contemplate phenomena like market sentiment or regulatory shifts impacting their operations.

Furthermore, successful mining operations increasingly incorporate predictive analytics to forecast regional electricity costs and potential downtime caused by fluctuations in power supply. The synergy of all these elements—real-time data capture, mining efficiency, predictive analytics, and hardware choices—creates a formidable framework that can elevate a miner’s performance in the digital space.

In conclusion, staying ahead in the competitive field of cryptocurrency mining necessitates a delicate blend of informed decision-making and adaptive strategies. By leveraging real-time data, miners can enhance their yields, make smarter choices about equipment and hosting, and capitalize on market movements. As the crypto ecosystem continues to evolve, those who master the art of interpreting data will be the ones with the upper hand, driving their success in an ever-changing landscape.

You may also like

1 comment

Leave a Reply Cancel reply

Archives

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

A deep dive into data’s power, transforming crypto mining from guesswork to goldmine. Real-time analytics unlock efficiencies, maximizing profits and minimizing risk in the volatile crypto landscape.