Navigating the Ethereum Mining Rig Market: Price Predictions and Recommendations for 2025

The digital currency landscape is a dynamic realm, constantly evolving with technological advancements and shifting market sentiments. Within this ecosystem, Ethereum mining rigs occupy a crucial niche, representing the hardware foundation upon which the Ethereum blockchain operates. As we approach 2025, understanding the factors influencing the price and performance of these rigs becomes paramount for both seasoned miners and newcomers alike. Price predictions, while inherently speculative, offer valuable insights into potential investment strategies and risk management.

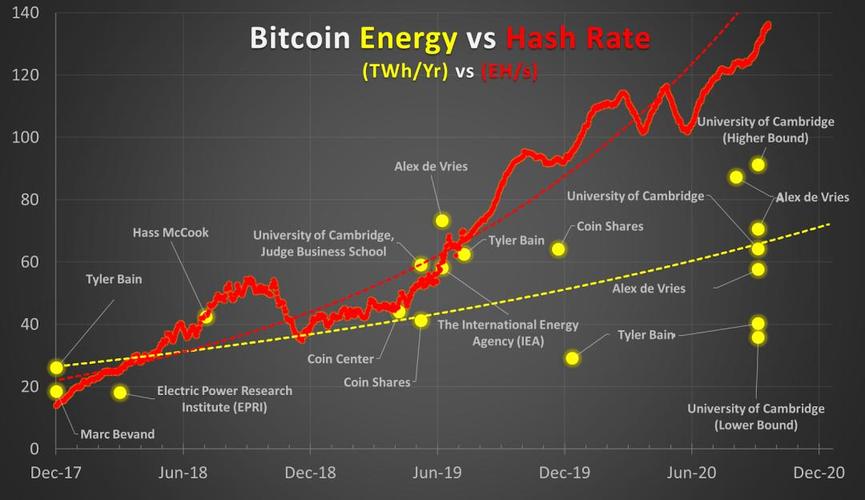

The price of Ethereum mining rigs is intricately linked to a complex interplay of factors. Firstly, the price of Ethereum itself plays a pivotal role. A bullish Ethereum market typically spurs demand for mining rigs, driving up prices as miners seek to capitalize on increased profitability. Conversely, a bearish market can dampen demand, leading to price declines. Secondly, technological advancements in GPU (Graphics Processing Unit) technology directly impact rig performance and efficiency. Newer generation GPUs offer superior hash rates and lower power consumption, making older rigs less competitive and potentially depreciating their value. Furthermore, network difficulty, which measures the computational effort required to mine a block, also influences profitability. An increasing difficulty makes mining more challenging, potentially affecting the demand for and pricing of rigs.

The transition of Ethereum from Proof-of-Work (PoW) to Proof-of-Stake (PoS) with the Merge significantly impacted the mining landscape. PoS eliminates the need for energy-intensive mining, rendering existing Ethereum mining rigs obsolete for their original purpose. This dramatic shift had a cascading effect on the market, flooding it with used GPUs and driving down prices. However, miners quickly adapted, repurposing their rigs for mining other cryptocurrencies that still utilize PoW algorithms, such as Ethereum Classic, Ravencoin, and Beam. The future profitability of these alternative cryptocurrencies will significantly influence the demand and value of repurposed Ethereum mining rigs in 2025.

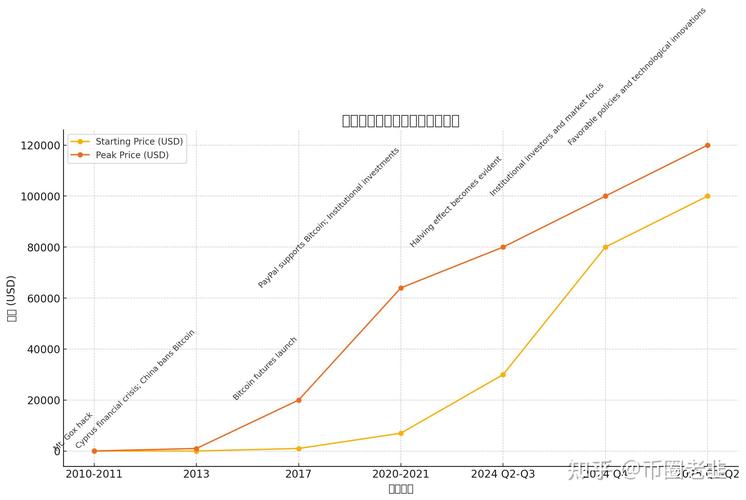

Accurately predicting the price of Ethereum mining rigs in 2025 is inherently challenging due to the inherent volatility of the cryptocurrency market and the rapid pace of technological innovation. However, based on current trends and expert analysis, several potential scenarios emerge. If Ethereum continues to thrive and other PoW cryptocurrencies gain significant traction, the demand for repurposed mining rigs could remain relatively stable, albeit at lower price points than pre-Merge levels. In this scenario, rigs equipped with high-performance GPUs could retain some value, while older, less efficient models may become less desirable. Alternatively, if the cryptocurrency market experiences a prolonged downturn or if alternative PoW cryptocurrencies fail to gain widespread adoption, the demand for mining rigs could further decline, leading to substantial price drops.

For those considering entering or remaining in the Ethereum mining rig market, several recommendations are prudent. Firstly, thoroughly research the potential profitability of mining alternative PoW cryptocurrencies. Consider factors such as network difficulty, block rewards, and electricity costs. Secondly, prioritize rigs equipped with newer generation GPUs that offer superior hash rates and lower power consumption. These rigs are likely to be more competitive and retain their value better over time. Thirdly, carefully assess the risks associated with investing in mining rigs, considering the volatility of the cryptocurrency market and the potential for technological obsolescence. Diversifying your cryptocurrency portfolio and investing only what you can afford to lose are crucial strategies. Finally, explore options for cloud mining or mining pools, which can offer access to shared resources and potentially lower upfront costs. These options allow individuals to participate in mining without the need to purchase and maintain their own equipment.

Beyond individual miners, the concept of mining farms has also evolved. These large-scale operations require significant investment and infrastructure, focusing on optimizing efficiency and minimizing operational costs. The future of mining farms in the post-Merge era hinges on their ability to adapt and diversify. Some farms have successfully transitioned to mining other PoW cryptocurrencies, while others are exploring alternative applications for their infrastructure, such as providing cloud computing services or hosting other blockchain-related applications. The long-term viability of mining farms will depend on their ability to innovate and remain competitive in a rapidly changing landscape. The emergence of more sustainable energy sources and environmentally conscious mining practices is also becoming increasingly important, driven by growing concerns about the environmental impact of cryptocurrency mining.

Ultimately, navigating the Ethereum mining rig market in 2025 requires a comprehensive understanding of the underlying technologies, market dynamics, and risk factors. While predicting the future with certainty is impossible, by carefully analyzing available data and adopting a prudent approach, investors can make informed decisions and position themselves for potential success in this ever-evolving landscape. The key lies in adaptability, continuous learning, and a willingness to embrace new opportunities.

You may also like

1 comment

Leave a Reply Cancel reply

Archives

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

Ethereum mining’s future is murky post-Merge. This analysis speculates on 2025 rig values, factoring in proof-of-stake’s impact, potential forks, and alternative coin mining. A gamble, but informed.