Maximizing ROI: 2025 Bitcoin Mining Hardware Review and Price Analysis

In the explosive realm of cryptocurrency, Bitcoin mining remains a cornerstone of the digital economy, an endeavor that melds cutting-edge technology with the relentless pursuit of profit. As 2025 unfurls, miners and investors alike confront a pivotal question: which mining hardware truly maximizes ROI in this intensely competitive landscape? The marketplace brims with options—from venerable ASIC miners to innovative mining rigs designed for efficiency and scalability. Understanding the nuances of each device, their power consumption, hash rates, and initial costs, alongside fluctuating Bitcoin prices and network difficulty, is essential for anyone seeking a foothold in this digital gold rush.

At the heart of mining profitability lies the delicate interplay between hardware capability and electricity expenses. Top-tier ASIC miners like the Antminer S21 Pro or MicroBT’s WhatsMiner M73S+ offer hash rates exceeding 120 TH/s, pushing computational power to new heights. However, raw power alone doesn’t guarantee success; energy efficiency dictates long-term viability. For instance, a miner delivering 100 TH/s at 30 J/TH can outperform a 130 TH/s model consuming 45 J/TH when electricity prices surge. Hence, miners must balance upfront investment and operational costs meticulously to maximize returns in 2025’s volatile market conditions.

Complementing hardware performance is the strategic deployment of mining machine hosting services. Hosting providers, often operating sprawling mining farms equipped with industrial-scale cooling and power infrastructures, offer an attractive proposition: miners can lease operational space, obviating the complexities and maintenance hassles of running machines independently. This model not only removes barriers to entry but also taps into economies of scale, where bulk electricity procurement and sophisticated cooling yield cost efficiencies. Consequently, miners leveraging hosting services can focus on scaling hash power while sidestepping logistical constraints—a critical advantage amid Bitcoin’s escalating network difficulty.

Beyond Bitcoin, altcoins such as Ethereum (ETH) and Dogecoin (DOGE) introduce layered opportunities and challenges. Ethereum’s shift towards proof-of-stake has curtailed traditional mining profitability, nudging miners to diversify or pivot. Yet, Ethereum-compatible rigs remain relevant for dual mining setups or transition scenarios. Meanwhile, mining rigs carved out for Dogecoin or combined Scrypt algorithm coins may offer niche returns, albeit generally eclipsed by Bitcoin’s market dominance. Diversifying coin portfolios and tweaking hardware configurations ensures miners buffer against market swings across the crypto spectrum.

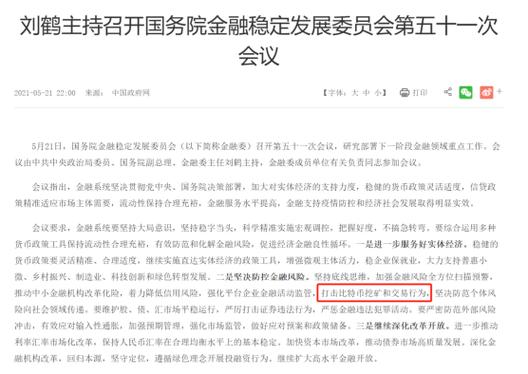

The marketplace pulsates further with the presence of cryptocurrency exchanges, pivotal hubs where mined coins metamorphose into liquid assets. Exchanges not only serve as conduits for trading Bitcoin, Ethereum, and Dogecoin but also influence miners’ strategic decisions. Spot market volatility impacts when miners choose to convert holdings, while futures and options can hedge against price swings—offering insurance amidst the digital tempest. Exchanges’ evolving fee structures and regional regulations introduce additional calculus into miners’ ROI equations, underscoring the interconnectedness between mining infrastructure and market ecosystems.

Looking ahead, advancements such as immersion cooling, AI-powered mining management, and renewable energy adoption herald a new era of sustainable profitability. Miners pioneering these technologies may reduce operating expenses dramatically, outpacing competitors reliant on legacy systems. Furthermore, localized mining farms empowered by green energy cannibalize traditional energy costs, fortifying resilience against regulatory headwinds and power outages. This convergence of innovation and eco-consciousness shapes the next frontier for those daring to maximize their bitcoin mining ROI in 2025.

In conclusion, the quest to maximize ROI in Bitcoin mining hardware in 2025 demands a multifaceted approach—evaluating not just raw hash rates but the synergy between power efficiency, hosting solutions, coin diversification, and market fluidity. Whether deploying sophisticated ASIC miners, embracing hosting farms, or integrating smart energy strategies, miners equipped with comprehensive insights stand poised to extract maximal value from the digital mine. Vigilance, adaptability, and technological foresight will remain the definitive keys unlocking profitability in the fast-evolving world of cryptocurrency mining.

You may also like

1 comment

Leave a Reply to Theodore Cancel reply

Archives

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

This insightful review delves into the evolving landscape of Bitcoin mining hardware for 2025, offering a detailed price analysis and performance evaluation. It examines efficiency, cost-effectiveness, and sustainability, guiding investors in optimizing their ROI amidst fluctuating market conditions. A must-read for tech-savvy miners and enthusiasts alike.