Embracing the Digital Gold Rush: Strategies for Accurately Acquiring Litecoin Miners in Canada

The allure of digital gold, specifically Litecoin, shimmers brightly for many Canadian investors and entrepreneurs. The promise of passive income and participation in the decentralized financial revolution is a powerful draw. However, venturing into the world of cryptocurrency mining, especially Litecoin mining in Canada, requires more than just enthusiasm. It demands a strategic approach, a keen understanding of the market, and, crucially, the accurate acquisition of Litecoin miners – the very engines of this digital gold rush.

The Canadian landscape for cryptocurrency mining presents both opportunities and challenges. Electricity costs, climate conditions, and regulatory environments vary significantly across provinces. Before even considering purchasing a Litecoin miner, meticulous research into these factors is paramount. British Columbia, with its relatively lower electricity rates and cooler climate, might be a more appealing location than, say, the Yukon. Similarly, understanding provincial regulations regarding cryptocurrency mining and its environmental impact is crucial for long-term sustainability and compliance.

But what exactly is a Litecoin miner? In essence, it’s a specialized computer, often referred to as an ASIC (Application-Specific Integrated Circuit) miner, designed to solve complex mathematical problems. These solutions validate Litecoin transactions and, in return, the miner receives a reward in the form of newly minted Litecoins. The efficiency of a miner is measured by its hash rate – the speed at which it can perform these calculations. A higher hash rate generally translates to a greater probability of earning rewards.

Acquiring the right Litecoin miner is where accuracy becomes absolutely critical. The market is flooded with various models, each boasting different hash rates, power consumption levels, and price points. Falling prey to misleading marketing or unreliable vendors can result in significant financial losses. Begin by thoroughly researching reputable manufacturers and suppliers. Online forums, cryptocurrency communities, and independent review websites are invaluable resources for gathering information and comparing miner specifications.

Consider factors beyond just the initial purchase price. Power consumption is a major ongoing expense. A more powerful miner might generate more Litecoins, but it will also consume more electricity. Calculate the break-even point – the time it takes for the mining rewards to offset the initial investment and operating costs – to determine the true profitability of a particular miner.

Another crucial aspect is the miner’s algorithm. Litecoin, like Dogecoin, uses the Scrypt algorithm. Ensure the miner you’re considering is specifically designed for Scrypt mining. Bitcoin miners, for example, use the SHA-256 algorithm and are completely incompatible with Litecoin. Purchasing the wrong type of miner is a costly and easily avoidable mistake.

Beyond individual miners, consider the possibility of mining pools. A mining pool is a collaborative effort where multiple miners combine their computing power to increase their chances of finding a block and earning rewards. The rewards are then distributed proportionally based on each miner’s contribution to the pool’s overall hash rate. Joining a reputable mining pool can provide more consistent income than solo mining, although it does involve sharing the rewards.

For those seeking a more hands-off approach, mining machine hosting offers a viable alternative. Hosting companies provide the infrastructure, including electricity, cooling, and maintenance, for your Litecoin miners. You essentially rent space and resources from them, paying a fee for their services. This can be a convenient option for individuals who lack the technical expertise or the physical space to set up and maintain their own mining operation. However, it’s essential to thoroughly vet the hosting provider, ensuring they have a secure and reliable facility with competitive pricing.

Navigating the cryptocurrency exchange landscape is also integral to the entire Litecoin mining process. After successfully mining Litecoins, you’ll likely want to convert them into fiat currency (Canadian dollars, for example) or other cryptocurrencies like Bitcoin or Ethereum. Cryptocurrency exchanges act as marketplaces where you can buy, sell, and trade digital assets. Choose a reputable exchange with strong security measures and reasonable transaction fees. Familiarize yourself with the exchange’s policies on withdrawals, deposits, and trading limits.

The regulatory environment surrounding cryptocurrencies in Canada is constantly evolving. Stay informed about any changes in legislation that could affect your mining operations. Compliance with tax regulations is also essential. Accurately track your mining income and expenses to ensure you meet your tax obligations.

Ultimately, accurately acquiring Litecoin miners in Canada requires a multifaceted approach. It’s not just about finding the cheapest miner; it’s about conducting thorough research, understanding the technical aspects of mining, carefully considering the financial implications, and staying informed about the ever-changing regulatory landscape. By embracing this strategic approach, you can significantly increase your chances of success in the digital gold rush and reap the rewards of participating in the decentralized financial revolution.

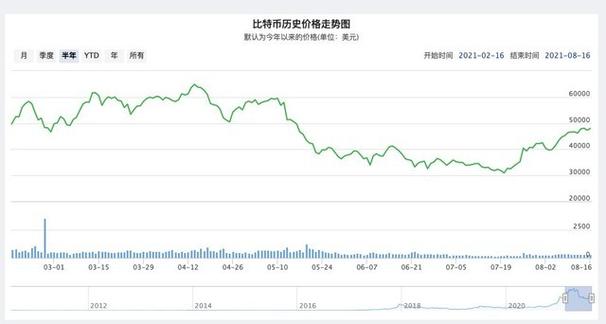

The price of Litecoin, along with Bitcoin and Ethereum, is inherently volatile. Market fluctuations can significantly impact the profitability of mining. A sudden drop in Litecoin’s value can render your mining operation unprofitable, even with the most efficient miners. Manage your risk by diversifying your investments and considering strategies such as dollar-cost averaging when converting your Litecoin earnings into other assets. The world of cryptocurrency is rife with opportunity, but prudent risk management is essential for long-term success.

You may also like

1 comment

Leave a Reply Cancel reply

Archives

Calendar

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | ||||

| 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| 11 | 12 | 13 | 14 | 15 | 16 | 17 |

| 18 | 19 | 20 | 21 | 22 | 23 | 24 |

| 25 | 26 | 27 | 28 | 29 | 30 | 31 |

This article delves into the emerging trends of cryptocurrency mining in Canada, particularly focusing on Litecoin. It offers insightful strategies for investors, emphasizing the importance of due diligence and technology awareness. Rich in data and real-world examples, it presents a compelling guide for navigating the digital gold rush effectively.